Black-Scholes

Games for suits. This post has no relevance in the greater scheme of things.

As a premise, consider that the financial industry needs instruments of wealth creation that work opposite to that of stocks. For example, when stock prices remain low, then something else else should take up the slack -- otherwise important people won't make money. Wall Street invented derivatives, options, and other hedging methods to serve as an investment vehicle under these conditions.

We can try to show how this works.

If S is the stock price, then V ~ 1/S is an example "derivative" that works as a reciprocal to price. This becomes the normative description and defines the basic objective as to what the investment class wants to achieve -- an alternate form of income that balances swings in stock price, potentially reducing risk.

Further, we make the assumption that the derivative will grow or decline over time.

So we get:

V(S,t) = K/S * exp(a*t)

If a > 0 then the derivative will grow and if a is less than zero than the derivative will damp out over time. The term K is a constant of proportionality.

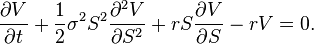

The infamous Black-Scholes equation supposedly governs the behaviour of derivatives with respect to stock prices (and time) according to this invariant:

The particulars may change but this formulation describes THE equation that Merton, Black, and Scholes devised to aid investors in making hedged investments using options and other derivatives. The way to read this equation is to note that derivatives will drift or diffuse into the space of the stock price, and proportional to the stock price itself. The drift term occurs due to the interest rate r providing a kind of forcing function. The derivative, V, can also grow due to pure interest rate compounding, as seen in the last term. Whether this actually holds or not, I don't really care as I don't participate in these schemes.

So if you look at it from a very neutral perspective you come up with some interesting observations. For one, you can trivially solve this partial differential equation for a generally disordered set of initial conditions. And the solution appears exactly the same as my first expression above:

V(S,t) = K/S * exp(a*t)

To verify this assertion, we test the expression in the B-S equation, substituting the partial derivatives as we go along.

a*K/S* exp(a*t) + 1/2(σS)2*2*K/S2*exp(a*t) - rS*K/S2*exp(a*t) - r*K/S * exp(a*t) = 0

Cancelling out all common factors:

a/S + 1/2(σS)2*2/S2- rS/S2 - r/S = 0

Reducing the value of S

a/S + 1/2(σ)2*2/S- r/S - r/S = 0

a + 1/2(σ)2*2- r - r = 0

gets us to:

a = 2*r - σ2

The term r is proportional to interest, and σ is volatility or variance in stock price.

So this simple expression that I just cooked up will obey Black-Scholes as long as we choose the constant a term to correspond to the interest and volatility as shown above, and we get:

V(S,t) = K/S * exp((2*r - σ2)*t)

Note that if the volatility (i.e. diffusion) stays high relative to interest, the exponential will damp out with time. If interest (i.e. drift) goes higher than volatility, the exponential will accelerate, creating a huge amount of paper gains.

At this point someone will argue that this solution does not reflect reality. I beg to differ. When you make your bed of mathematical box-springs, you have to lie in it. This solution to Black-Scholes is perfectly fine as it gives a steady-state picture of the partial differential equation. The diffusional and drift components cancel with the right mix of production vs destruction in derivative wealth. If you don't like it, then come up with something different than that specific B-S equation.

I have a feeling that all the seeming complexity of financial quantitative analysis with its Ito calculus and Wiener processes acts as a shiny facade to a simple reality. The math exists to model the inverse relationship of stocks to derivatives. If this didn't happen -- and the lords of high finance absolutely require this relationship to make money -- the math as formulated would vanish from their toolbox. In other words, the math only exists to justify what the financial operatives want to see happen. Everyone appears to implicitly buy this mathematical artifice hook, line, and sinker.

Quantitative analysis and the "quants" who work it have created a fantasy land, where they do not want you to know how easily their quaint ornate universe reduces to a simple function. If they admitted to the charade, the mystery would all disappear and they would no longer have jobs.

Economics and finance does not constitute a science. In science you may need to use partial differential equations. For example, the Fokker-Planck equation shows up quite often -- which incidentally, the Black-Scholes equation shows some similarity to and the quant proponents of B-S certainly like to play up -- but it typically applies to real, physical systems where you use it to try to understand nature, not trying to model some artificial game-like behavior.

I can edit my solution into the Wikipedia page for Black-Scholes and I will bet that someone will immediately remove it. I harbor no illusions. The financial industry depends on the absence of real knowledge to achieve their objectives.

That explains why economics and finance do not classify as sciences; absolute truth does not matter to economists and financiers, only the art of deconstructing profit and the craft of phantom wealth creation does.

4 Comments:

Can you talk about the equivalence of BSM to the Heat Equation?

Would you care to comment on the similarities between BSM and the Heat Equation?

This is the transformation V ~ 1/S.

If you get rid of that then you get the Fokker-Planck which you can use for heat transfer.

Thanks for sharing. Please do visit the link below.

Energy Analysis

Post a Comment

<< Home